Financial Analysis

ACME Company’s financial position compared with the same industry standards.

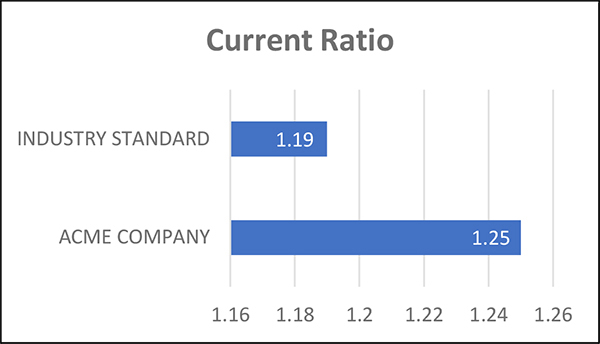

- Current Ratio

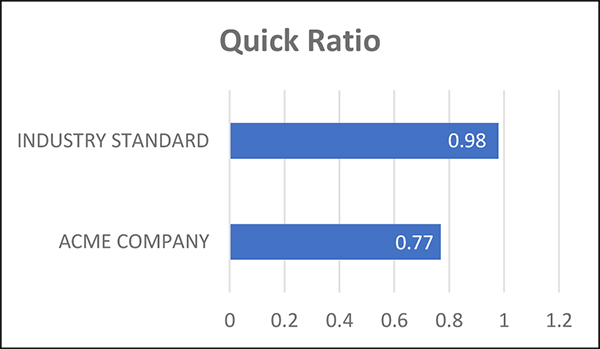

- Quick Ratio

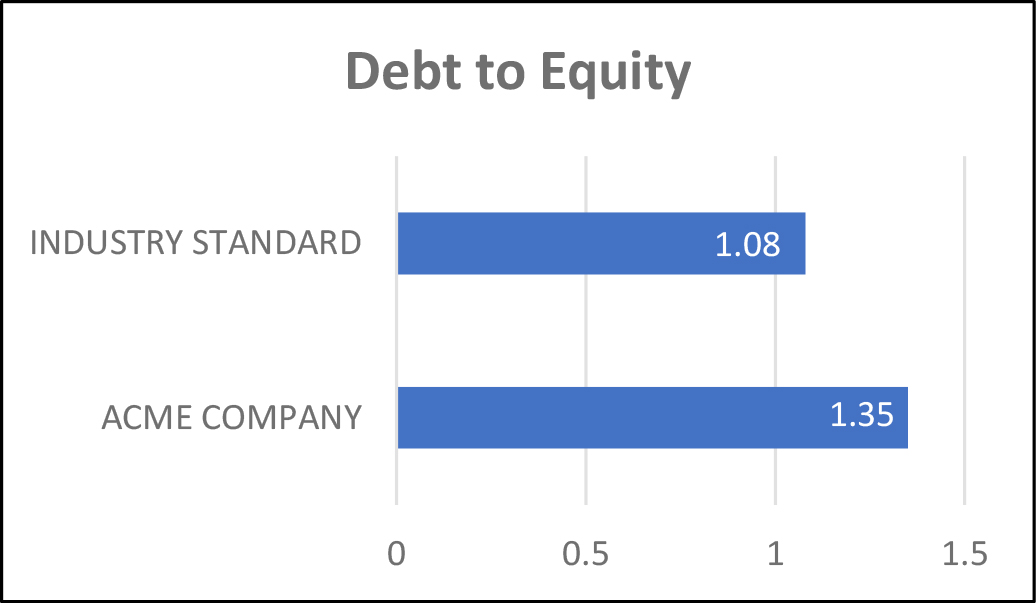

- Debt to Equity

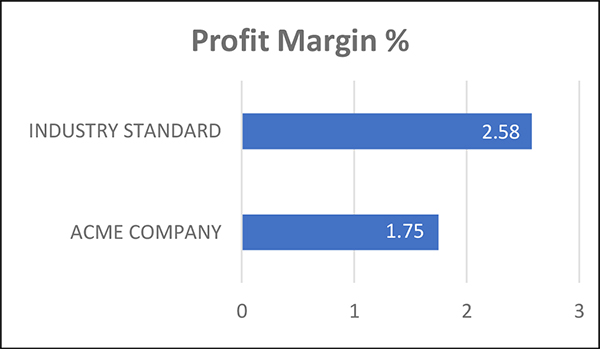

- Profit Margin Percentage

Current Ratio

The current ratio is a liquidity ratio that measures a company's ability to pay short-term and long-term financial obligations. To gauge this ability, the current ratio considers the current total assets of a company, both liquid and illiquid, relative to that company’s current total liabilities.

Quick Ratio

The quick ratio is an indicator of a company’s shortterm liquidity. The ratio measures a company's ability to meet its short-term obligations with its most liquid assets. A quick ratio of 1:1 indicates that the company has one dollar of liquidity for every one dollar of liability.

Debt to Equity

Debt to equity ratio is a debt ratio used to measure a company’s financial leverage, which is calculated by dividing a company’s total liabilities by its stockholders’ equity. The debt to equity ratio indicates how much debt a company is using to finance its assets relative to the amount of value represented in shareholders’ equity.

Profit Margin %

Profit margins are expressed as a percentage and measure how much out of every dollar a company keeps in earnings. A 20% margin means the company has a net income of $0.20 for each dollar of total earned revenue.